The Medicare Prescription Payment Plan: Automation Can Help Pharmacies Shine

The MPPP will allow patients to pay their out-of-pocket costs for covered Part D drugs over time, easing financial stress associated with deductibles and cost sharing for expensive drugs.

by Lisa Schwartz, Pharm.D., R.Ph.

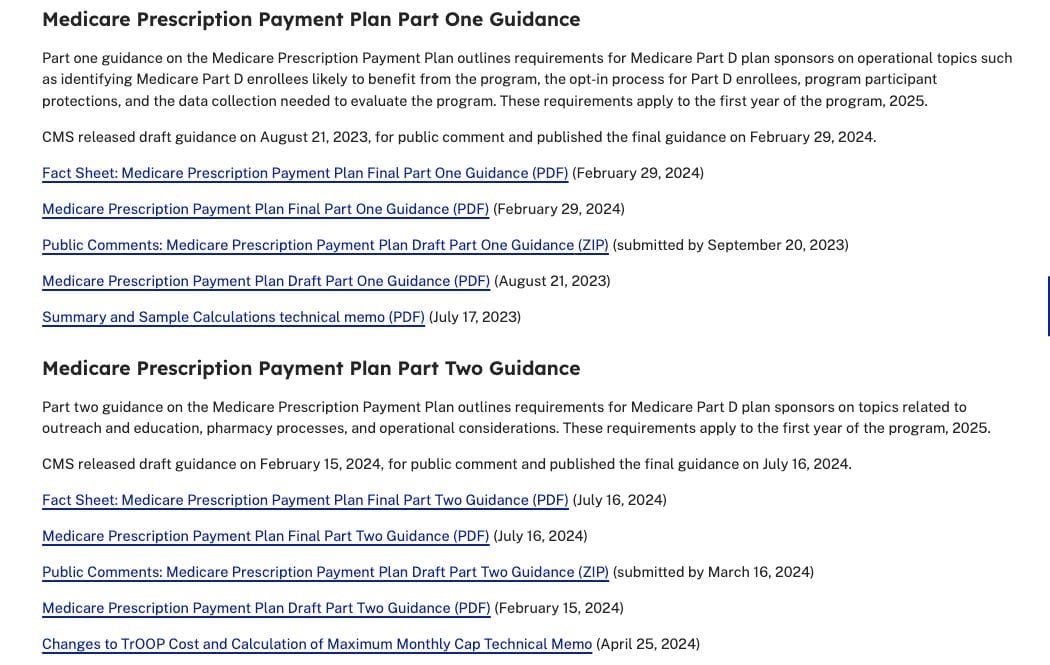

The Medicare prescription payment plan (MPPP) is possibly the biggest change to the Medicare Part D drug benefit since Part D plans hit the market in 2006. The MPPP (also sometimes referred to as M3P) will allow patients to pay their out-of-pocket costs for covered Part D drugs over time, easing financial stress associated with deductibles and cost sharing for expensive drugs. Patients can opt in during open enrollment this fall (October 15–December 7) and at any time during the plan year. They won’t have any copays due at the pharmacy and will instead receive a monthly invoice from their plan. The pharmacy still receives the contract rate, but may see the amount paid by the MPPP itemized on the 835 (Electronic Remittance Advice) or being received from a processor other than the PBM (pharmacy benefit manager) for the Part D plan — all within the 14-day payment window.